- English

Again we see this view of four hikes in 2022 as hypothetical and aligned with the newfound vision of the Fed offering maximum optionality.

Fed member Harker commented in late US trade, suggesting “the Fed won’t ignore the performance of financial markets”. Bingo, the Fed’s undisclosed mandate has once again been cemented in the notion of keeping the NAS100 and S&P500 from falling too far, subsequently impacting the wealth effect too greatly – hence, if equities and credit move too intently then the market knows the Fed will pivot the stance hard….once again.

The ‘Fed put’ is there, we just think the strike price (for a pivot to a more dovish stance) is 10-15% lower.

However, despite this endless cycle of news on Fed hikes and balance sheet reduction, the fact that the USD has simply not responded to hawkish comments from the Fed has come up time and again from clients, and the broader market - and there are many theses flying around about this negative USD flow.

Daily chart of the USDX

(Source: TradingVIew - Past performance is not indicative of future performance.)

The JPY is the weakest currency on the day, however, as risk is buoyant, and subsequently CADJPY is breaking out on the daily, as is NOKJPY, and for momentum traders who like to buy strong, these are the plays – trade as a swing or take into lower timeframes and scalp the flow.

The USDX is trading right at range lows, with EURUSD (57% weight in the USD basket) grinding to the top of its range at 1.1380 – one can sense the market leaning short of USDs into today’s US CPI print – with expectations of headline CPI at 7% and core 5.4%. So, the question is would a stronger downside reaction (in the USD) be seen on a miss to CPI than an upside move (in the USD) on a beat? I suspect the former and it feels as if the street sees this risk distribution and looking for reasons to get short the USD.

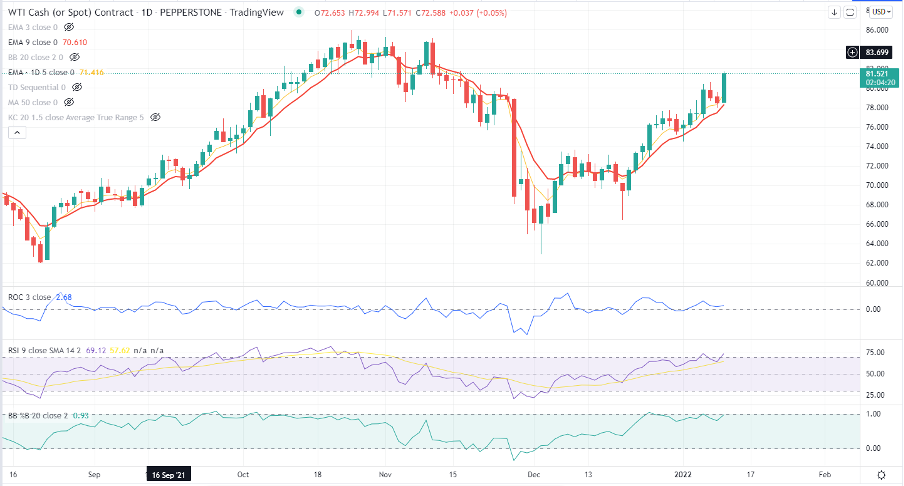

Daily of Spot Crude

(Source: TradingVIew - Past performance is not indicative of future performance.)

A decent move lower in US real rates amid USD weakness is typically a green light for gold bulls, and bid up the yellow metal the market has, putting on $18 on the day. We eye the $1830 swing here (also the 61.8 fibo of the Nov-Dec sell-off), where we may see better supply, but a break would take this unloved play into $1870. Again, we’ve had many false starts in XAUUSD, but I have been wholly impressed by the yellow to ride out the recent lift in bond yields and that may be telling a story that the Gold bulls may have a better time of it in Q1.

I mentioned Crude above and perhaps we do see $86 in our sights, but the Commodity complex is firing up today, with industrial plays working, and ag’s also firing up. I like the shape of Nat Gas and for the trend-followers out there put some OJ on the radar - it's making consistent higher highs and CTAs would be all over this.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.